- Green deal

- Courtesy : carnegieendowment.org/

- New agricultural standards. As part of its “Farm to Fork” policy package, the EU aims to become a leader in setting sustainable global food standards. Compliance with these standards as a condition for accessing the European market could constitute additional nontariff barriers for African agriculture exports to the EU. Still, an EU-Africa partnership can help combat agroecological challenges.

- EU-Africa biodiversity strategy. NaturAfrica is the EGD’s biodiversity strategy to protect wildlife and ecosystems, provide local populations with economic opportunities in green sectors, and strengthen the links between biodiversity protection and Indigenous communities. To successfully design and implement NaturAfrica, Europe must take into account the human rights abuses and land dispossession that often accompany conservation initiatives. The initiative can complement existing programs such as the Pan-African Agenda on Ecosystem Restoration for Increased Resilience.

- Shifting demand from fossil fuels to cleaner energy sources. The EGD’s energy strategy aims to secure affordable energy supply, increase clean energy, and replace fossil fuels in the carbon-intensive energy mix. In achieving these objectives, a European phaseout of oil by 2050 could lead to a decrease in oil demand and declining prices for African suppliers, particularly after 2030. The fossil fuel phaseout is already causing a decline in upstream investments by European development agencies, concessional lenders, and private financiers of hydrocarbon projects in Africa. Europe’s plans to use decarbonized gas as a transition fuel would present some short-term opportunities for African gas producers. With an increasing European demand for green hydrogen, partnerships are being established with African countries through the European Clean Hydrogen Alliance to secure 40 gigawatts of hydrogen imports from non-EU countries by 2030.

- Rising demand for critical raw materials. The low-carbon energy strategies envisioned in the EGD will depend on the CRM inputs for clean energy and technologies. Consumption of these CRMs is projected to increase by a factor of four for graphite, five for cobalt, and eighteen for lithium by 2030; and by a factor of thirteen for graphite, fourteen for cobalt, and nearly sixty for lithium by 2050. Currently, the EU sources 28 percent of its barite needs from Morocco, 64 percent of bauxite from Guinea, 68 percent of cobalt and 36 percent of tantalum from the Democratic Republic of the Congo (DRC), and about 90 percent of the platinum group metals (PGM) from South Africa. Other countries, such as Ghana, Zambia, and Zimbabwe, also have the potential to supply copper, PGM, and bauxite to Europe. The projected demand in CRMs creates opportunities for Africa to replace Asian supply chains. There are, however, risks of reinforcing technology dependencies for Africa, accelerating environmental devastation, compounding climate disruptions, and importing Europe’s carbon emissions.

- Creating a circular economy. The EGD’s circular economy action plan aims to reduce material throughput by reusing and recycling materials. The plan is meant to provide a guideline for all sectors, with action focusing on resource-intensive sectors such as textiles, construction, electronics, and plastics. For some sectors in African countries, this could present new economic opportunities, as relocalizing part of the circular economy value chain to African producers could strengthen manufacturing, allowing African businesses to engage in higher-value activities. It is important to align the EU’s circular economy plan with existing African initiatives, such as the African Circular Economy Alliance, which was founded by Nigeria, Rwanda, and South Africa.

- Deployment of new technologies. The EGD aims to scale commercial applications of breakthrough green technology innovations and create corresponding markets to secure an advantage over competitors in the United States and China. African countries will struggle to adopt these emerging green technologies, some of which are still very costly. However, competition between producers, especially the EU and China, could lead to early price decreases and could enable African countries to proactively negotiate skills, knowledge, and technology transfer as well as the localization of jobs around these new technologies. Around 35 percent of Horizon Europe, a 95.5-billion-euro ($113.5 billion) research and innovation funding program from 2021 to 2027, is dedicated to climate research. There could be collaboration opportunities between stakeholders in industry and research communities in Europe and Africa.

- Financing the EGD. To achieve its 2030 emissions targets, the European Commission estimates that annual investments of 260 billion euros ($309.4 billion) will be needed. In total, the EU aims to mobilize at least 1 trillion euros in sustainable investments over a decade through international carbon markets, the revision of the European emissions trading system, and a carbon border adjustment mechanism (CBAM). As the CBAM could impose costs on exporters from low-income countries, including those in Africa, such unintended consequences should be mitigated in consultation with those to be affected. While the EGD does not outline a spending plan, it is worth noting that the amount of climate funds from the European Commission and the EU’s lending arm, the European Investment Bank (EIB), to developing countries has not increased from an average of around 5.7 billion euros ($6.7 billion) since 2018. Neither has it shifted away from a preponderance of nonconcessional loans over grant financing by the EIB nor have both institutions’ focuses shifted from climate mitigation initiatives toward adaptation and resilience. The focus has also been on wealthier, middle-income countries rather than low-income economies.

RELATED ANALYSIS FROM CARNEGIE

POLICY RECOMMENDATIONS

The EGD is mainly an internal policy instrument, yet its potential global spillovers will reach African countries in view of the strong economic and historical ties between the continents. Such effects will be felt in the market for agriculture, fossil fuels, and other natural resources. The impacts will also occur through the channels of Europe’s financial muscle, technologies, and standards.

No outcome is predetermined, however. In fact, the transition envisioned in the EGD offers the promise of overhauling EU-Africa relations from the donor-recipient orientation of the past toward a mutually beneficial partnership in the twenty-first century if the right steps are taken now. These steps include:

- Forging genuine partnerships in sourcing CRMs and energy supplies from Africa by building industrial capacity, localizing value chains, and sharing technologies. Clean energy hardware industries, such as battery and solar photovoltaic manufacturing plants, can be set up in mineral-rich countries, like the DRC, as the EU shifts from Chinese supply chains.

- Aligning areas of the EGD that directly affect Africa with the continent’s own stated development priorities. These African priorities are outlined in continent-wide, subregional, or domestic policy documents. Overall, Europe should not use its financial muscle and technological standards to impose its foreign policy and geopolitical interests at the expense of Africa’s own development aspirations.

- Matching the EU’s stated principles around sustainability with actual volumes of climate financing to Africa. This climate financing should be separated from official development assistance and provided either as grants or at concessional rates to avoid saddling poor countries with unsustainable debt. The financing should also be rebalanced from its current heavy focus on climate mitigation toward climate adaptation and resilience.

To tap into the opportunities presented by the EGD and mitigate potential risks, African countries must clearly articulate and assert their own climate transition agendas. They should outline their own climate change priorities, considering their resource endowments, historical legacies, development strategies, and geopolitical interests, while also presenting clear demands of the EU around specific aspects of the EGD. Elements of these transition agendas can include:

- Updating geological surveys of their endowments of fossil fuels, CRMs, and renewable resources to help attract foreign direct investment (FDI).

- Strengthening market-creating instruments by updating local content laws, policies, and regulations to reflect the low-carbon transition and to cover the specificities of CRMs.

- Working closely with local private sectors to leverage new financial instruments emerging in the context of the EGD toward job creation, skills upgrading, technology adoption, and investments in research and development to power local innovation.

- Developing their own overarching climate action strategy by finalizing the African Union’s climate action plan; updating sector-specific strategies in areas such as mining, biodiversity, the circular economy, and agriculture; and developing common positions on managing the energy transition, especially the various aspects of the oncoming fossil fuel obsolescence in Europe.

Research communities have a role to play as well. There are knowledge gaps where further study is needed: on generating better data and conducting in-depth forecasting, conceptualizing a just transition for Africa attuned to the continent’s realities, examining how to avoid replicating the technology dominance and dependency of the oil and gas era, and advocating for clarity on the allocation of EU climate financing across industries, sectors, and countries.

THE EUROPEAN GREEN DEAL: A VISION TO COMBAT CLIMATE CHANGE

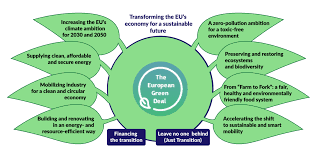

The EGD is a roadmap for a socioecological transition to a low-carbon future and provides building blocks for a green economic strategy in Europe.1 It comprises eight detailed policy areas (see appendix 1) as well as a European Climate Pact and a European Climate Law. The EGD aims to deliver on the European Commission’s vision to reach net zero emissions of greenhouse gases by 2050, decouple economic growth from resource use, and leave no person or place behind. The EU aspires to be the first mover in a global race to define new sustainability standards, develop green technologies, and establish future markets. As an intermediate step toward achieving the EGD objectives by 2050, the European Commission adopted on July 14, 2021, the Fit for 55 package of policy proposals to cut emissions by at least 55 percent from 1990 levels by 2030.2

Olumide Abimbola

Olumide Abimbola is executive director of the Africa Policy Research Institute in Berlin.

The emerging path toward a net zero carbon future as outlined in the EGD matters greatly for African countries. The EU is the world’s third-largest economy after China and the United States, representing 16 percent of global gross domestic product (GDP) in purchasing power parity.3 It is also one of the three largest actors in international trade, accounting for 15.6 percent of global imports and exports.4 Therefore, reduced European demand for fossil fuels could depress global commodity prices, reduce the revenues of oil-dependent African countries, and disrupt their economies. At the same time, Europe’s transition to a green future could benefit African countries that have important “green” minerals, like cobalt and nickel, in abundance. As the EU is Africa’s largest trade partner—with a 28 percent share of both exports and imports with the continent—and is home to four of the ten economies that invested the most FDI in Africa between 2015 and 2019, Africa can expect other impacts as the EGD reshapes the EU economy, governance, and foreign policy.5>

This paper seeks to identify the implications of key EGD components for African countries. This analysis draws on the European Commission’s communications published under the banner of the EU Green Deal and other communications published in this context. The analysis is structured around seven main areas: agriculture, biodiversity, energy, CRMs, circular economy, new technologies, and finance.

AFRICA IN THE EGD: THE NUMBERS AT STAKE

- The African continent exports 5 billion euros ($19.6 billion) worth of agriculture produce to the EU, with agri-food making up 16 percent of EU-Africa trade.

- In 2019, oil exports represented the largest share of EU-Africa trade, with the EU importing 842,362 million barrels of crude oil worth 7 billion euros ($55.7 billion) from African countries.

- Africa is the fastest-growing region of gas production at an average growth rate of 5.6 percent per year, and, according to the International Energy Agency, it is expected to account for 295 billion cubic meters of global supplies in 2025. Europe’s gas import requirements will remain stable until 2025 and will rise thereafter to supplement declining domestic gas production.

- Green hydrogen FDI from Europe to Africa could reach 75.6 billion euros ($90 billion) by 2030.

- Europe will mobilize 1 trillion euros in sustainable investment by 2030—a significant part of it on research and development, and some in partnership with African stakeholders through Horizon Europe.

- The EU’s consumption of CRMs for batteries, fuel cells, wind turbines, and photovoltaic cells (PVs) in renewables and electric vehicles (EVs) will increase by a factor of four for raphite, five for cobalt, and eighteen for lithium by 2030 and by a factor of thirteen for graphite, fourteen for cobalt, and nearly sixty for lithium by 2050.

- The EU currently sources 28 percent of its barite needs from Morocco, 64 percent of bauxite from Guinea, 68 percent of cobalt and 36 percent of tantalum from the DRC, and about 90 percent of PGM from South Africa. Other countries, such as Zambia, Zimbabwe, and Ghana also have the potential to supply copper, PGM, and bauxite to the EU.

- With 28 percent of the world’s registered patents in environmentally related innovations, the EU is a leader in the green technological transition.

- In 2018, the ten countries that received the most climate financing from EU institutions included only three in Africa, all of which— Cameroon (82 million euros or $97 million), Egypt (208 million euros or $247 million), and Morocco (429 million euros or $510 million)—are middle-income countries.

SEVEN IMPLICATIONS OF THE EGD FOR AFRICA

NEW AGRICULTURAL STANDARDS: FARM TO FORK STRATEGY

The farm-to-fork strategy is a policy package that aims to promote an agroecological, healthy, and affordable food system in the EU. It is a cornerstone of the EGD. As part of the strategy, the EU seeks to promote new global food standards with the aim of becoming a standard setter for sustainability.6 Agriculture is one of the main export sectors in Africa: it absorbs about 50 percent of the labor force and accounts for 40 percent of GDP.7 Agri-food trade between Africa and Europe makes up approximately 16 percent of total exports trade with Europe, amounting to about 16.5 billion euros ($19.6 billion). Cocoa makes up 33.4 percent of the trade, while edible fruits and nuts represent 24.3 percent.8

Requiring compliance with food regulations as a condition for accessing the EU market is a strong incentive for exporting countries to adapt to the EU’s new standards.9 However, it will constitute an additional nontariff barrier for African countries. Currently, under the EU’s Common Agricultural Policy (CAP), EU farmers receive up to 50 percent of their income as direct payments. This has, in part, helped to make the EU the leading global exporter of agri-food and given its farmers a competitive advantage over their African peers. Thus, new food regulations under the EDG will further burden African countries, since they do not enjoy the CAP subsidy and are already challenged with meeting European market rules of origin as well as sanitary and phytosanitary standards. As one of the core EU policies, the CAP is key to helping the union achieve its ambitions in the agricultural sector. The reformed CAP stipulates that 30 percent of the overall EU budget must contribute toward climate objectives.10 A study by the Center for Development Research in Germany suggests that stronger environmental and climate guidelines could dampen European agricultural exports to Africa.11

The EU can nevertheless partner with Africa in its efforts to combat agroecological challenges. The African agricultural sector faces serious threats from both climate change and land degradation. If land degradation continues at the current pace, more than half of the cultivated agricultural area in Africa will be unusable by 2050.12 African countries can adapt to and even combat the manifestations of climate change with the use of agroecological technologies. The EU can provide financial and technological assistance to complement Africa’s effort. One avenue to channel such support can be through the African Union’s Comprehensive African Agricultural Development Program, which aims to address Africa’s agroecological threats and accelerate adaptation to new standards.13