Courtesy : en.wikipedia.org

Green economy

A green economy is an economy that aims at reducing environmental risks and ecological scarcities, and that aims for sustainable development without degrading the environment. It is closely related with ecological economics, but has a more politically applied focus.The 2011 UNEP Green Economy Report argues “that to be green, an economy must not only be efficient, but also fair. Fairness implies recognizing global and country level equity dimensions, particularly in assuring a Just Transition to an economy that is low-carbon, resource efficient, and socially inclusive.”

A feature distinguishing it from prior economic regimes is the direct valuation of natural capital and ecological services as having economic value (see The Economics of Ecosystems and Biodiversity and Bank of Natural Capital) and a full cost accounting regime in which costs externalized onto society via ecosystems are reliably traced back to, and accounted for as liabilities of, the entity that does the harm or neglects an asset

Green sticker and ecolabel practices have emerged as consumer facing indicators of friendliness to the environment and sustainable development. Many industries are starting to adopt these standards as a way to promote their greening practices in a globalizing economy. Also known as sustainability standards, these standards are special rules that guarantee the products bought don’t hurt the environment and the people that make them. The number of these standards has grown recently and they can now help build a new, greener economy. They focus on economic sectors like forestry, farming, mining or fishing among others; concentrate on environmental factors like protecting water sources and biodiversity, or reducing greenhouse gas emissions; support social protections and workers’ rights; and home in on specific parts of production processes.

Green economists and economics

Green economics is loosely defined as any theory of economics by which an economy is considered to be component of the ecosystem in which it resides (after Lynn Margulis). A holistic approach to the subject is typical, such that economic ideas are commingled with any number of other subjects, depending on the particular theorist. Proponents of feminism, postmodernism, the environmental movement, peace movement, Green politics, green anarchism and anti-globalization movement have used the term to describe very different ideas, all external to mainstream economics.

The use of the term is further ambiguated by the political distinction of Green parties which are formally organized and claim the capitalised Green term as a unique and distinguishing mark. It is thus preferable to refer to a loose school of “‘green economists”‘ who generally advocate shifts towards a green economy, biomimicry and a fuller accounting for biodiversity. (See The Economics of Ecosystems and Biodiversity especially for current authoritative international work towards these goals and Bank of Natural Capital for a layperson’s presentation of these.)

Some economists view green economics as a branch or subfield of more established schools. For instance, it is regarded as classical economics where the traditional land is generalized to natural capital and has some attributes in common with labor and physical capital (since natural capital assets like rivers directly substitute for man-made ones such as canals). Or, it is viewed as Marxist economics with nature represented as a form of Lumpenproletariat, an exploited base of non-human workers providing surplus value to the human economy, or as a branch of neoclassical economics in which the price of life for developing vs. developed nations is held steady at a ratio reflecting a balance of power and that of non-human life is very low.

An increasing commitment by the UNEP (and national governments such as the UK) to the ideas of natural capital and full cost accounting under the banner ‘green economy’ could blur distinctions between the schools and redefine them all as variations of “green economics”. As of 2010 the Bretton Woods institutions (notably the World Bank and International Monetary Fund (via its “Green Fund” initiative) responsible for global monetary policy have stated a clear intention to move towards biodiversity valuation and a more official and universal biodiversity finance. Taking these into account targeting not less but radically zero emission and waste is what is promoted by the Zero Emissions Research and Initiatives. The UNEP 2011 Green Economy Report informs that “based on existing studies, the annual financing demand to green the global economy was estimated to be in the range US$1.05 to US$2.59 trillion. To place this demand in perspective, it is about one-tenth of total global investment per year, as measured by global Gross Capital Formation.”

At COP26, the European Investment Bank announced a set of just transition common principles agreed upon with multilateral development banks, which also align with the Paris Agreement. The principles refer to focusing financing on the transition to net zero carbon economies, while keeping socioeconomic effects in mind, along with policy engagement and plans for inclusion and gender equality, all aiming to deliver long-term economic transformation.

The African Development Bank, Asian Development Bank, Islamic Development Bank, Council of Europe Development Bank, Asian Infrastructure Investment Bank, European Bank for Reconstruction and Development, New Development Bank, and Inter-American Development Bank are among the multilateral development banks that have vowed to uphold the principles of climate change mitigation and a Just Transition. The World Bank Group also contributed.

Definition

Karl Burkart defined a green economy as based on six main sectors:

- Renewable energy

- Green buildings

- Sustainable transport

- Water management

- Waste management

- Land management

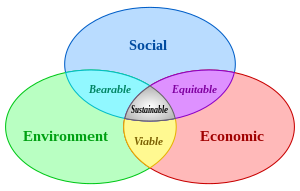

The three pillars of sustainability

The International Chamber of Commerce (ICC) representing global business defines green economy as “an economy in which economic growth and environmental responsibility work together in a mutually reinforcing fashion while supporting progress on social development”.

In 2012, the ICC published the Green Economy Roadmap, containing contributions from international experts consulted bi-yearly. The Roadmap represents a comprehensive and multidisciplinary effort to clarify and frame the concept of “green economy”. It highlights the role of business in bringing solutions to global challenges. It sets out the following 10 conditions which relate to business/intra-industry and collaborative action for a transition towards a green economy:

- Open and competitive markets

- Metrics, accounting, and reporting

- Finance and investment

- Awareness

- Life cycle approach

- Resource efficiency and decoupling

- Employment

- Education and skills

- Governance and partnership

- Integrated policy and decision-making

Finance and investing

This section is an excerpt from Eco-investing.

Eco-investing or green investing, is a form of socially responsible investing where investments are made in companies that support or provide environmentally friendly products and practices. These companies encourage (and often profit from) new technologies that support the transition from carbon dependence to more sustainable alternatives. Green finance is “any structured financial activity that has been created to ensure a better environmental outcome.”

As industries’ environmental impacts become more apparent, green topics have not only taken center stage in pop-culture, but the financial world as well. In the 1990s, many investors “began to look for those companies that were better than their competitors in terms of managing their environmental impact.” While some investors still focus their funds to avoid only “the most egregious polluters,” the emphasis for many investors has switched to changing “the way money is used,” and using “it in a positive, transformative way to get us from where we are now ultimately to a truly sustainable society.” Investment in companies that are damaging to the environment, and investment into the infrastructure that supports those companies detracts from environmentally sustainable investment. The Global Climate Prosperity Scoreboard – launched by Ethical Markets Media and The Climate Prosperity Alliance to monitor private investments in green companies – estimated that over $1.248 trillion has been invested in solar, wind, geothermal, ocean/hydro and other green sectors since 2007. This number represents investments from North America, China, India, and Brazil, as well at other developing countries.

Green growth

This section is an excerpt from Green growth.

Wind Turbine with Workers – Boryspil – Ukraine

Green growth is a term to describe a hypothetical path of economic growth that is environmentally sustainable. It is based on the understanding that as long as economic growth remains a predominant goal, a decoupling of economic growth from resource use and adverse environmental impacts is required. As such, green growth is closely related to the concepts of green economy and low-carbon or sustainable development. A main driver for green growth is the transition towards sustainable energy systems. Advocates of green growth policies argue that well-implemented green policies can create opportunities for employment in sectors such as renewable energy, green agriculture, or sustainable forestry.

Several countries and international organizations, such as the Organisation for Economic Co-operation and Development (OECD), World Bank, and United Nations, have developed strategies on green growth; others, such as the Global Green Growth Institute (GGGI), are specifically dedicated to the issue. The term green growth has been used to describe national or international strategies, for example as part of economic recovery from the COVID-19 recession, often framed as a green recovery.Critics of green growth highlight how green growth approaches do not fully account for the underlying economic systems change needed in order to address the climate crisis, biodiversity crisis and other environmental degradation. Critics point instead to alternative frameworks for economic change such as a circular economy, degrowth, doughnut economics or similar fundamental changes which better account for planetary boundaries.

Approximately 57% of businesses responding to a survey are investing in energy efficiency, 64% in reducing and recycling trash, and 32% in new, less polluting industries and technologies. Roughly 40% of businesses made investments in energy efficiency in 2021.

Ecological measurements

Measuring economic output and progress is done through the use of economic index indicators. Green indices emerged from the need to measure human ecological impact, efficiency sectors like transport, energy, buildings and tourism, as well as the investment flows targeted to areas like renewable energy and cleantech innovation.

- 2016 – 2022 Green Score City Indexis an ongoing study measuring the anthropogenic impact human activity has on nature.

- 2010 – 2018 Global Green Economy Index™ (GGEI), published by consultancy Dual Citizen LLC is in its 6th edition. It measures the green economic performance and perceptions of it in 130 countries along four main dimensions of leadership & climate change, efficiency sectors, markets & investment and the environment.

- 2009 – 2013 Circles of Sustainability project scored 5 cities in 5 separate countries.

- 2009 – 2012 Green City Index A global study commissioned by Siemens

Ecological footprint measurements are a way to gauge anthropogenic impact and are another standard used by municipal governments.